Property Flipping: A Lucrative Real Estate Investment Strategy

You’ll probably see professional real estate investors and sometimes regular neighbors take unsightly homes and make them into breathtaking residences. When done correctly, this can be a great method to see a return on investment immediately. But mistakes are equally simple to make. The world of house flipping is yours to explore. Whether you’re a seasoned investor or a novice looking to enter the real estate market, understanding the art of property flipping can help you navigate this potentially lucrative opportunity. Let’s discuss house flipping and what it takes to profit on a property.

What is Property Flipping?

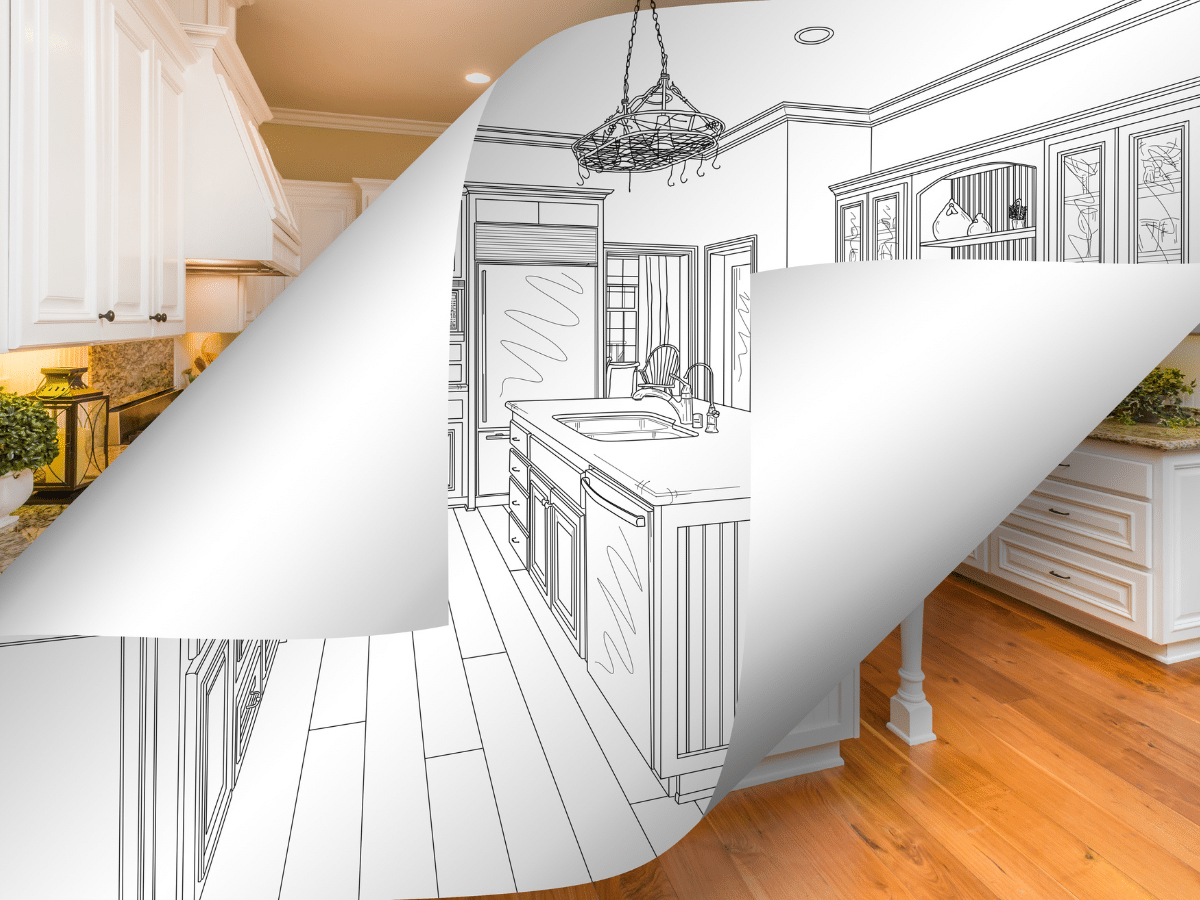

Property flipping is a popular real estate investing strategy that has recently gaining much attention. It refers to investing in distressed or undervalued properties to quickly renovate and resell them for a profit. Flippers maximize their profits on investment by using their market knowledge, restoration expertise, and effective project management. They often buy these properties for less, make changes to them, and then sell them for more to get a large return on their investment in a reasonable amount of time.

That said, successful flippers can identify homes with unrealized potential, anticipate adjustments that will raise their value, and make the necessary improvements to entice buyers. However, for this investment approach, having a keen sense of market trends, familiarity with local real estate dynamics, and an understanding of the renovation process is essential.

Even though real estate investing can be financially rewarding, numerous challenges exist. Flippers must manage the complexities of real estate transactions, accurately predict renovation costs, and carefully analyze market circumstances. Thus, market volatility, unforeseen costs, and regulatory considerations must be considered to ensure a successful flip. Investors may be able to take advantage of market opportunities, make money, and develop a profitable real estate portfolio by comprehending the fundamentals of property flipping and using a calculated approach.

The Benefits of Property Flipping

1. Generate Quick Profits

Successful property flipping can generate sizable earnings in a rather short amount of time. Flippers can generate large financial advantages by finding undervalued properties, strategically remodeling them, and profiting from market growth. Comparing profitable flips to conventional buy-and-hold real estate strategies can reveal larger earnings.

2. Active Investment Strategy

Investors can actively participate in the real estate market through property flipping. It offers a chance to use entrepreneurship, vision, and creativity while making money. By remodeling and refurbishing abandoned houses, real estate flipping helps to revitalize urban areas by raising the attraction and value of the surrounding area.

3. Shorter investing Timeframe

Property flipping offers a speedier turnaround than other real estate investing options. It allows investors to purchase, restore, and sell homes in a shorter time than standard buy-and-hold investments, which may take many years to see profits. This shortened investing cycle allows Investors to reinvest their money quickly and potentially more frequently.

Key Steps in Property Flipping

1. Market Research and Analysis

Flippers must do in-depth market research to spot new trends, choose ideal communities to target, and assess the profit margin. To do this, it is necessary to examine local development plans, rental demand, economic data, and property pricing.

2. Property Acquisition

Flippers must look for distressed properties that can be bought for less than market value, such as foreclosures or renovations. Important tasks at this point include doing due diligence and negotiating advantageous deals.

3. Renovation and Upgrades

Strategic upgrades and renovations that raise the home’s value are necessary for a profitable property flip. Flippers should carefully plan the scope of the work, get quotes from contractors in a competitive position, and properly manage the remodeling process.

4. Pricing and Marketing

Flippers must choose the best-selling price depending on the state of the property, current market conditions, and anticipated buyer demand. Staging, expert photography, and targeted advertising are examples of effective marketing strategies that can draw in potential customers and stimulate attention.

Risks and Challenges in Property Flipping

1. Market Volatility

Flippers are subject to inherent risks brought on by changes in the market, recessions, and consumer preferences. These risks can be reduced by following market movements and having backup strategies.

2. Financial Management

Flippers must carefully manage their money, including transaction fees, holding costs, remodeling expenditures, and purchase costs. Accurate budgeting and cash flow monitoring are essential to prevent cost overruns and preserve profitability.

3. Regulatory and Legal Considerations

For a property flipping business to be effective, zoning and building codes must be followed, and the required permissions must be obtained. Flippers should consult legal professionals to preserve compliance and avoid legal issues.

Conclusion

Property flipping is a fascinating and potentially profitable business possibility in the real estate industry. If you’re interested in finding out more about the prospects of flipping houses as an investment strategy, Property Listhub Bookings can be a fantastic resource.

Real estate investors can find a range of homes suitable for flipping on Property Listhub Bookings, providing extensive property listings where you can find opportunities that match your criteria for investing and goals. Visit Property Listhub Bookings to learn about the world of property flipping and give yourself the tools and knowledge you require to succeed in this cutting-edge real estate investment strategy.